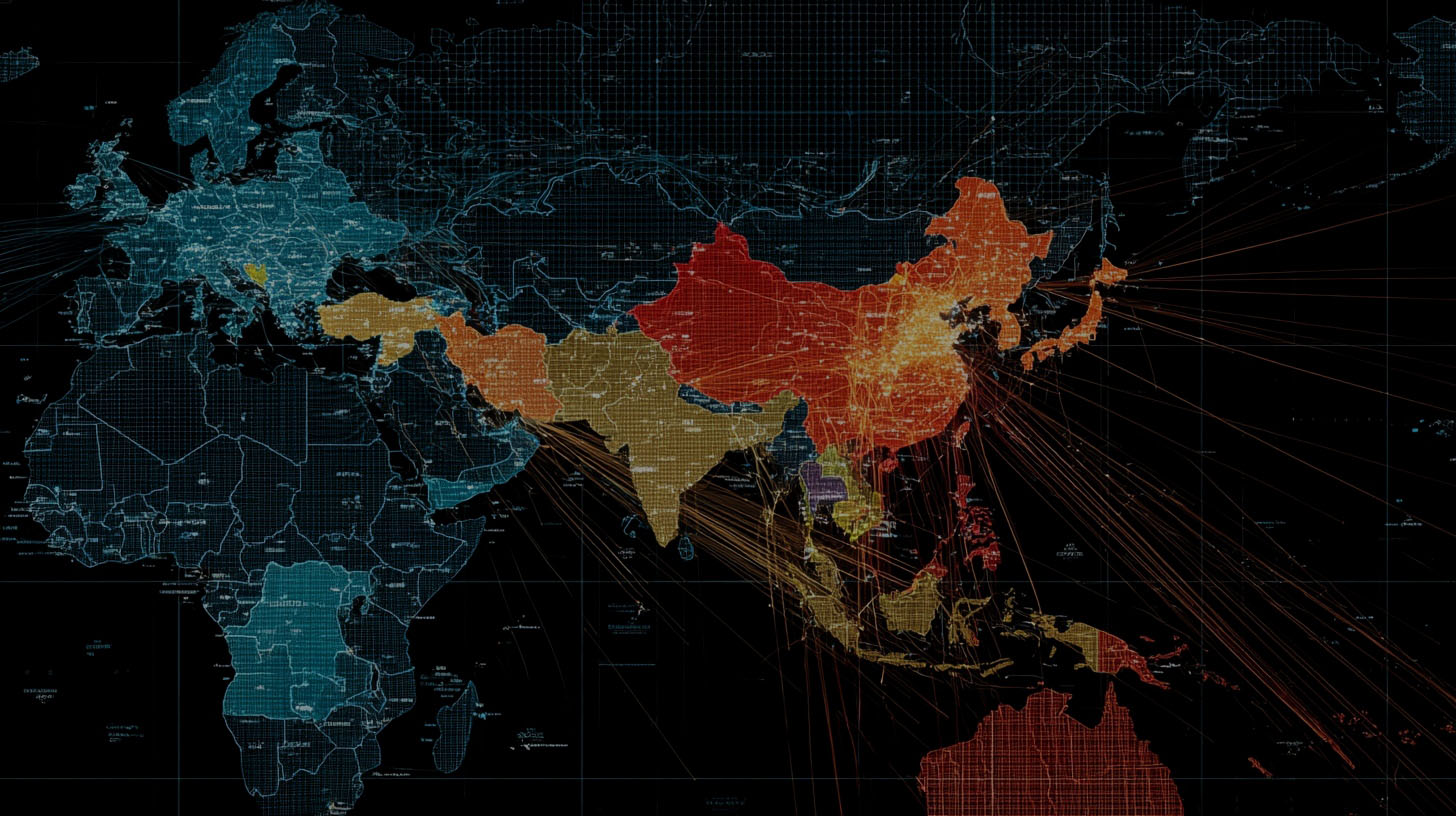

Escalating trade barriers, sanctions, and military actions reshape energy flows, tech alliances, and investment strategies worldwide.

At a glance – The past 24 hours have seen a marked escalation in global geopolitical tensions, with direct impacts on energy markets, technology supply chains, and cross-border investment flows. President Donald Trump’s announcement of 100% tariffs on imported patented pharmaceuticals unless manufacturers build U.S. plants, alongside new duties on furniture and heavy trucks effective October 1, signals a hardening U.S. stance on trade and industrial policy. Simultaneously, the U.S. administration approved Ukrainian strikes on Russian energy infrastructure, intensifying pressure on Moscow and contributing to a surge in global oil prices—the largest weekly gain in three months. These moves, coupled with efforts to decertify Colombia over surging cocaine production and a potential $20 billion swap line for Argentina, highlight the multifaceted nature of current geopolitical risks, with direct consequences for energy, supply chains, and financial markets.

Technology advance – Trade and technology frictions have intensified, particularly between China and Mexico. Beijing has launched a formal probe into Mexico’s planned 50% tariffs on Chinese goods, a move that could reshape global electronics and battery supply chains. China is projected to dominate 42% of global chipmaking capacity by 2028, according to SEMI forecasts, underscoring its growing influence in advanced manufacturing. In response, Samsung has slashed its 2nm foundry prices by 30% to counter TSMC’s 50% price hike, signaling a fierce battle for semiconductor market share. Meanwhile, Apple’s ongoing AI struggles have left it vulnerable in a sector where rivals have invested $1.5 trillion in next-generation technologies, raising concerns about the resilience of Western tech giants amid shifting trade alliances and regulatory headwinds.

Partnerships – In Eurasia, strategic alliances are being redefined as countries seek to secure critical infrastructure and supply routes. The recent US-Vietnam trade pact positions Hanoi as a pivotal player in the broader Indo-Pacific strategy, with implications for battery manufacturing and electric vehicle supply chains. Vietnam’s enhanced role is expected to attract significant investment from both American and Japanese firms, particularly in lithium processing and motor production. Meanwhile, Taiwan and South Korea are exploring deeper cooperation on cybersecurity, aiming to protect their advanced manufacturing sectors from escalating cyber threats linked to regional rivalries. These partnerships reflect a broader trend of countries seeking to insulate themselves from geopolitical shocks by diversifying alliances and supply sources.

Acquisitions/expansions – The World Bank’s International Centre for Settlement of Investment Disputes has barred Niger from trading uranium from the Somaïr mine, which was seized from French company Orano SA earlier this year. This ruling not only escalates tensions between Niger’s military government and France but also disrupts global uranium supply chains, with potential knock-on effects for battery and energy storage industries reliant on nuclear power. Orano’s press release confirms that Niger is prohibited from selling, transferring, or facilitating uranium exports from the mine, while the tribunal has also called for the release of Orano’s detained country representative. This development underscores the vulnerability of critical mineral supply chains to geopolitical interventions and legal disputes.

Regulatory/policy – U.S.–Turkey relations remain strained despite a cordial meeting between President Trump and Turkish President Tayyip Erdogan. Turkey’s purchase of Russian S-400 missile systems led to its expulsion from the F-35 fighter jet program and triggered U.S. sanctions, with Ankara now seeking to recover its $1.6 billion investment and secure advanced weaponry. The U.S. remains concerned about NATO interoperability and Turkey’s refusal to join Western sanctions against Russia, while Turkey’s support for Hamas and critical stance on Israel further complicate the alliance. Although tariffs have been reduced and economic relations show cautious improvement, underlying strategic divergences—especially regarding defense procurement and regional security—continue to pose significant risks to cross-border investment and technology transfer in the defense sector.

Finance/business – Geopolitical instability has fueled a rally in gold prices, with central banks in China, India, and Turkey collectively adding over 1,200 metric tons to their reserves in 2025. This shift away from dollar-dominated assets reflects growing concerns over the reliability of traditional safe-haven investments amid ongoing conflicts, sanctions, and trade disputes. According to the World Gold Council, gold’s negative correlation with equities during crises—such as the recent Gaza conflict and Iran-Israel standoffs—has made it an indispensable liquidity buffer for investors. The trend highlights a broader recalibration of asset allocation strategies in response to geopolitical fragmentation, with direct implications for financial markets, currency stability, and cross-border investment flows.

Sources: GeopoliticsUnplugged Substack, GeopoliticalMonitor, Bloomberg, SEMI, Modern Diplomacy, World Gold Council