Energy security, cross-border investment, and technology supply chains face mounting risks as conflicts and sanctions reshape the global landscape.

At a glance – The past 24 hours have seen a marked escalation in geopolitical volatility, with direct impacts on global energy flows, supply chains, and financial markets. The Russia-Ukraine conflict intensified as the U.S. administration authorized intelligence sharing to support Ukrainian strikes on Russian energy infrastructure, resulting in acute fuel shortages across Russia and Crimea. Simultaneously, G7 finance ministers pledged coordinated sanctions against countries importing Russian oil, signaling a tightening of global energy trade and further volatility in oil prices. In the Middle East, Israel’s acceptance of a U.S.-brokered peace proposal for Gaza, with support from Qatar and Egypt, has introduced a fragile diplomatic opening, though threats of renewed hostilities persist. Meanwhile, the U.S. government shutdown, triggered by legislative deadlock, is adding uncertainty to domestic and international markets, raising concerns about federal contract continuity and regulatory oversight in critical sectors.

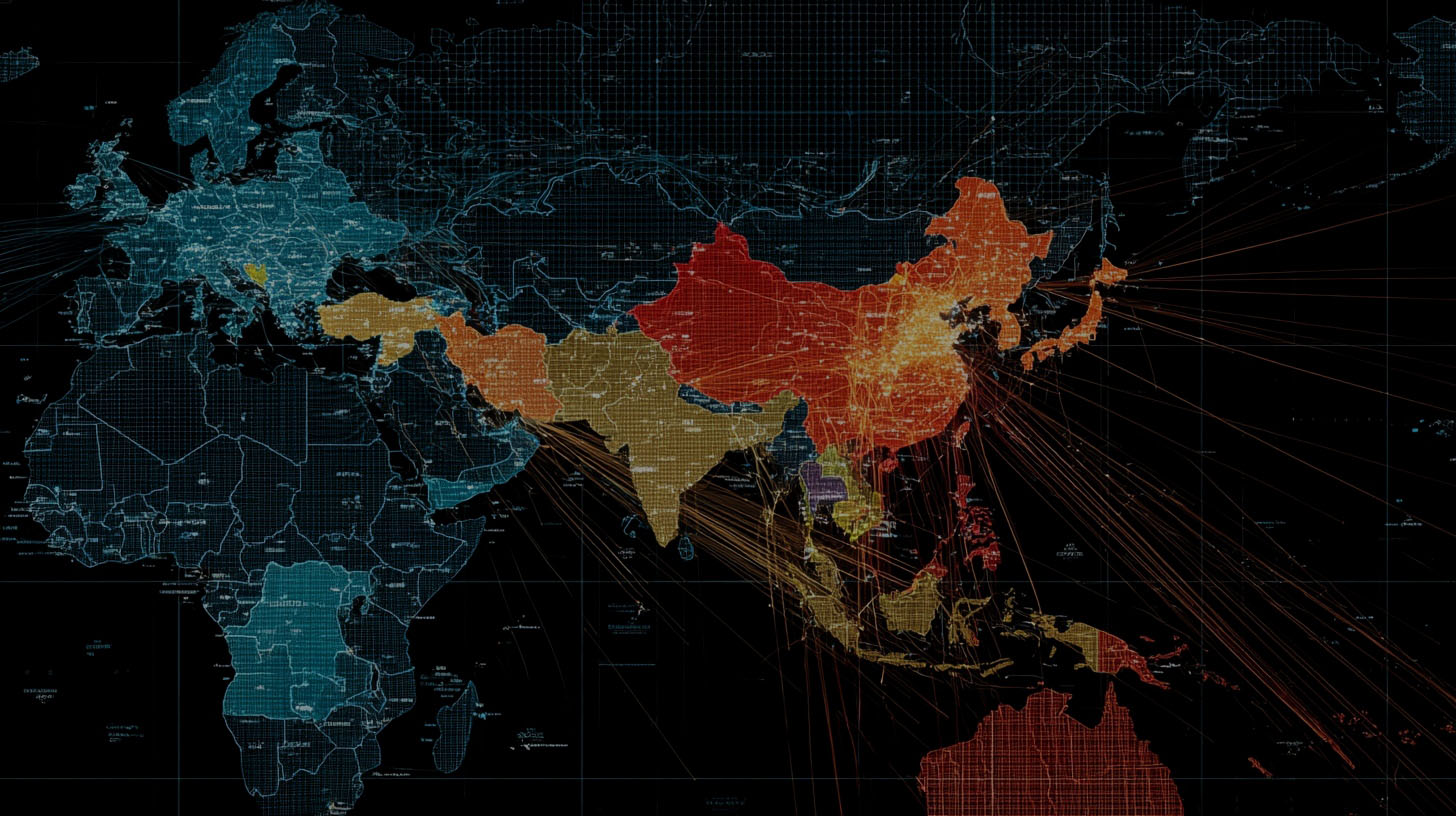

Technology advance – In the Indo-Pacific, leaked documents revealed that Russia has been providing China with advanced equipment and training for potential airborne operations targeting Taiwan, heightening concerns over the security of semiconductor and electronics supply chains. Taiwan’s government rejected a U.S. proposal to relocate half of its semiconductor industry to the United States, underscoring the island’s strategic importance and the ongoing struggle for technological dominance. The U.S. Trade Representative confirmed that there will be no immediate reduction in tariffs on Chinese goods, maintaining pressure on global electronics and battery supply chains. These developments are prompting multinational technology firms to reassess sourcing strategies and contingency plans for critical components, particularly in the battery and electric vehicle (EV) sectors.

Partnerships – The week also saw the conclusion of the U.S. administration’s review of its trilateral security treaty with the U.K. and Australia, with a decision to maintain the agreement in force. This move is expected to bolster joint research and development in advanced propulsion systems, naval defense technologies, and secure communications infrastructure. In parallel, India and Taiwan signaled a willingness to reduce purchases of Russian crude oil, potentially opening the door to new energy alliances and investment in alternative fuel infrastructure. These shifts are likely to accelerate cross-border collaborations in clean tech, particularly in hydrogen and grid-scale battery storage, as countries seek to diversify energy sources and reduce exposure to geopolitical shocks.

Acquisitions/expansions – In a significant development for the global minerals market, several Asia-Pacific governments announced new strategies to secure access to critical minerals essential for battery production and renewable energy projects. These initiatives include state-backed investments in lithium and cobalt mining operations in Africa and South America, as well as expanded joint ventures with private sector partners in Australia and Indonesia. The moves come amid heightened scrutiny of Chinese investments in the sector and growing concerns about supply chain resilience. Meanwhile, European leaders are weighing a $165 billion loan to Ukraine, backed by frozen Russian assets, which could catalyze reconstruction and infrastructure projects with major implications for regional energy and transportation networks.

Regulatory/policy – Regulatory risk remains elevated as governments respond to ongoing conflicts and economic headwinds. The U.S. government shutdown, now in its third day, is disrupting regulatory approvals and oversight for energy, transportation, and technology projects, with potential delays to federal funding for EV charging infrastructure and grid modernization. In the Middle East, U.S. President Donald Trump’s executive order providing security guarantees to Qatar following recent hostilities has shifted the regional security calculus, with implications for LNG exports and investment in Gulf energy infrastructure. In Madagascar, the dismissal of the prime minister and cabinet after deadly protests over electricity and water shortages highlights the political risks facing infrastructure investment in emerging markets.

Finance/business – Financial markets are reacting to these geopolitical shocks with heightened volatility. The ongoing Russia-Ukraine war and Middle East tensions have driven up energy prices, contributing to persistent inflation and elevated sovereign bond yields in advanced economies. S&P Global notes that central bank rate cuts in the U.S. and Western Europe may be overstated, with policy rates expected to remain above pre-pandemic levels. The anti-globalization movement and renewed protectionism are weighing on cross-border investment flows, particularly in the technology and clean energy sectors. Despite these challenges, the Asia-Pacific region is projected to remain a key engine of long-term growth, with enhanced policy stimulus in China and new investment opportunities emerging in critical minerals and advanced manufacturing.

Sources: New Lines Institute, S&P Global, Aon, U.S. Trade Representative, European Council, Madagascar Government Press Office