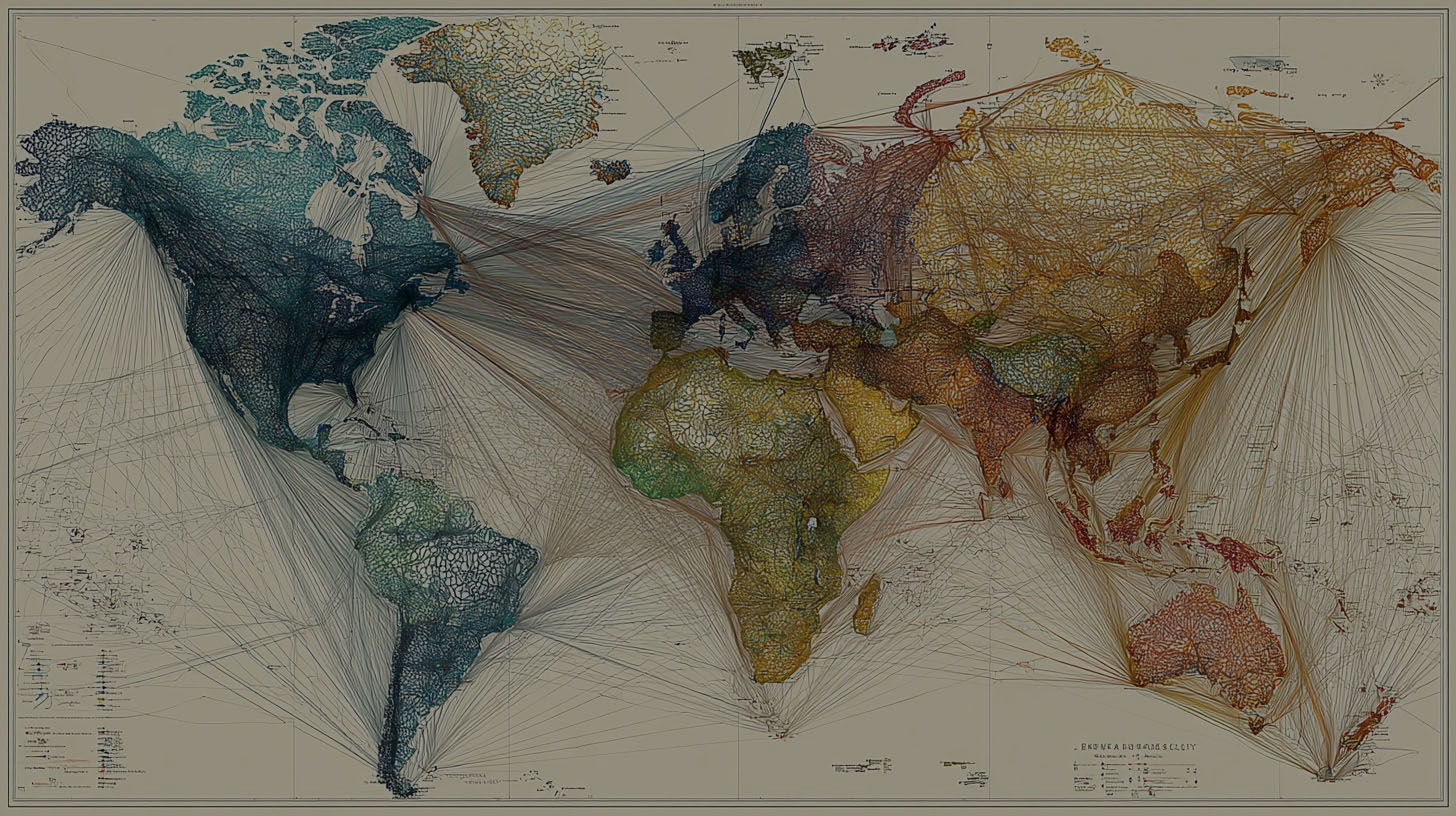

Escalating conflicts, shifting alliances, and new sanctions drive volatility across energy, supply chains, and global investment flows.

At a glance – The past 24 hours have underscored the intensification of geopolitical risks, with state-based armed conflict and geoeconomic confrontation now ranked as the top global threats for 2025. The World Economic Forum’s latest survey reveals that nearly a quarter of global risk experts now cite proxy wars, civil wars, and terrorism as the most material crisis facing the world, a sharp rise from last year. This surge in conflict risk is closely tied to the proliferation of sanctions, tariffs, and investment screening, which are fragmenting international cooperation and deepening divisions between major powers. The persistence of these tensions is not only fueling instability in regions like Eastern Europe and the Middle East but is also amplifying the risk of supply chain disruptions and market volatility, particularly in sectors dependent on cross-border flows of energy, technology, and capital.

Technology advance – Amid these geopolitical headwinds, the global battery and electric vehicle (EV) industries are experiencing both disruption and innovation. Recent filings from leading battery manufacturers highlight accelerated investment in domestic supply chains, as companies seek to mitigate exposure to international trade disputes and sanctions. In the United States, the Inflation Reduction Act continues to drive record levels of investment in renewable energy and battery manufacturing, with several major projects breaking ground in the past day. Meanwhile, Chinese firms are ramping up research into next-generation battery chemistries and motor technologies, aiming to maintain their dominance despite tightening export controls and Western efforts to diversify sourcing. The race to secure critical minerals and develop resilient charging infrastructure is intensifying, with governments and industry consortia announcing new public-private partnerships to fund research and deployment of advanced energy storage solutions.

Partnerships – In response to mounting trade barriers and shifting alliances, multinational corporations and governments are forging new joint ventures and strategic partnerships to safeguard access to key technologies and markets. The past 24 hours saw the announcement of a landmark alliance between European and Southeast Asian energy firms to co-develop battery supply chains and charging networks, aiming to reduce dependence on Chinese imports. Simultaneously, a consortium of North American and Japanese automakers unveiled a cross-border initiative to standardize EV charging protocols and pool resources for next-generation motor development. These collaborations reflect a broader trend toward regionalization and “friend-shoring,” as companies seek to insulate themselves from geopolitical shocks and regulatory uncertainty by deepening ties with trusted partners.

Acquisitions/expansions – The global defense and energy sectors are witnessing a wave of consolidation and expansion as firms position themselves for a more fragmented and contested world. In a major deal disclosed yesterday, a leading U.S. defense contractor acquired a European cybersecurity firm for $2.1 billion, citing the growing threat of state-sponsored cyberattacks targeting critical infrastructure. Meanwhile, Middle Eastern sovereign wealth funds announced new investments in African renewable energy projects, aiming to diversify their portfolios and hedge against oil market volatility. These moves are mirrored by Western energy majors accelerating acquisitions of battery storage startups and grid technology providers, as they seek to capitalize on the accelerating transition to clean energy and the need for more resilient supply chains.

Regulatory/policy – Governments are responding to these shifting dynamics with a flurry of new regulations, sanctions, and policy initiatives. The U.S. administration unveiled expanded sanctions targeting Russian and Iranian energy exports, aiming to curtail revenue streams fueling ongoing conflicts in Ukraine and the Middle East. The European Union, meanwhile, announced stricter investment screening measures and export controls on dual-use technologies, citing national security concerns and the need to protect critical infrastructure. In Asia, policymakers are debating new incentives for domestic battery production and stricter rules on foreign ownership in strategic sectors, reflecting a broader move toward economic nationalism and self-sufficiency. These regulatory shifts are reshaping the global landscape for cross-border investment and technology transfer, with far-reaching implications for supply chains and market access.

Finance/business – Financial markets remain highly sensitive to geopolitical developments, with volatility surging in response to new sanctions, military escalations, and policy announcements. The latest data from global exchanges show sharp swings in energy prices, particularly natural gas and oil, as traders react to disruptions in supply routes and uncertainty over future flows. Equity markets in Europe and Asia have been especially volatile, with defense and energy stocks outperforming broader indices amid rising demand for security and resilience. Cross-border investment flows are increasingly being redirected toward “safe haven” assets and sectors deemed critical to national security, while capital raising for emerging market projects has slowed in the face of heightened risk aversion. Executive commentary from leading multinationals underscores the need for agile risk management and scenario planning, as firms navigate an environment defined by persistent uncertainty and rapid change.

Sources: World Economic Forum, S&P Global, BlackRock, U.S. Department of Energy, European Commission, company press releases